On 14 October 2015, Turkish Policy Quarterly (TPQ) organized its sixth annual energy geopolitics roundtable titled, “Regional Natural Gas Game-Changers: Securing Supplies amid Volatility.” Barçın Yinanç, the op-ed editor of Hürriyet Daily News, moderated the discussion. The event was supported by BP Turkey for the 6th year running. The panelists, along with 70 participants, discussed EU diversification goals, Southern Gas Corridor (SGC) dynamics, Eastern Mediterranean natural gas prospects, and the role of renewables in the energy sector.

EU Diversification: How Will it Happen?

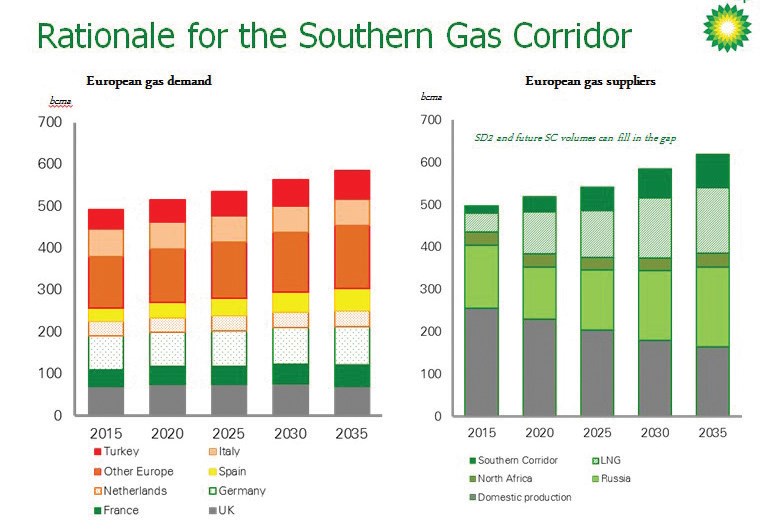

According to BP’s Energy Outlook 2035 data, the EU’s indigenous natural gas production is projected to decline by 80 bcm while consumption is to increase by 70 bcm in 2035.[1] The same data predicts that demand will grow primarily in Turkey and Southeast Europe (marked as other Europe in Figure 1). Bud Fackrell, the first speaker, and President of BP Turkey, explained that this demand can be supplied by three main sources: Russia, LNG imports, and the SGC.

Figure 1: Rationale for the Southern Gas Corridor

Source: BP Turkey

Russia’s actions in Ukraine in 2014, specifically the annexation of Crimea, has led to a sharp deterioration of relations between Russia and the West, and has given stronger impetus to decreasing European dependence on Russian natural gas. The abandonment of gas supplies from Russia is currently unrealistic; the 146 bcm of natural gas Russia’s Gazprom annually supplies to Europe cannot be replaced in the short-to-medium-term. However, the diversification of natural gas sources and routes can help wean Europe – particularly the heavily dependent countries in the southeast – off of Russian gas. Introducing more competition into the marketplace will not only weaken Russia’s ability to use natural gas as a political lever in its relations with the EU, but it will also push Russia to “play by the commercial rules of the game,” as Special Envoy and Coordinator for International Energy Affairs Amos Hochstein pointed out in his interview with TPQ.[2]

Addressing the topic of supply diversification, Douglas Hengel, the second speaker, and a Senior Resident Fellow at The German Marshall Fund of the United States, asserted that two currently debated projects that foresee delivering Russian natural gas to Europe – TurkStream and Nord Stream II – do not contribute to enhancing EU energy security. TurkStream, or “South Stream by another name,” as Hengel put it, essentially envisions transporting natural gas from the same Russian source but using a different route. TurkStream has a planned capacity of 64 bcm annually, and will have four parallel pipelines each carrying 16 bcm from Anapa, Russia to Kıyıköy, Turkey. Nord Stream II, the extension of Nord Stream I, has a planned capacity of 55 bcm, and will deliver gas from Russia to Germany through the Baltic Sea, bypassing Ukraine. Pipeline projects that aim to avoid gas exports through Ukraine are not in the best interest of the EU and, as Hengel noted, send a negative message about the EU’s commitment to support Kyiv by putting pressure on Russia.

Liquified Natural Gas (LNG) – including the regasification infrastructure which is used to restore liquid to gas form – was identified by all of the panelists as a true game-changer for the EU’s diversification goals. Hengel argued that US LNG exports in particular have the potential to significantly impact the global natural gas market. Hengel pointed out that there are five approved projects underway with the potential of exporting up to 90 bcm annually, and the first exports are poised to leave the US at the end of 2015. LNG presents a huge opportunity to counterbalance Russian natural gas volumes, especially for countries in the Baltic region and Southeast Europe that are heavily dependent on Russia.

Lithuania’s introduction of LNG import capability can be considered within this context. Before 2014, Lithuania was wholly dependent on Russia in receiving the 2.7 bcm of natural gas it consumed annually. The construction of an off-shore LNG terminal and the acquisition of an LNG ship – fittingly named Independence – are important steps for Lithuania in its efforts to reduce its dependence on Russia. On the economic front, Lithuania managed to negotiate a 23 percent price reduction.[3] On the political front, as Lithuania now has an alternative supply route that can completely replace Russian volumes, it is no longer susceptible to Moscow’s natural gas power-play in the Baltic region.

Aside from LNG, the other principal non-Russian source of supply that is able to feed European energy demands is Azeri pipeline gas via the SGC. Comprised of the South Caucasus Pipeline Expansion (SCPX), the Trans-Anatolian Pipeline (TANAP), and the Trans Adriatic Pipeline (TAP), the SGC will carry natural gas from the Shah Deniz II field in the Caspian Sea into Europe.

The Southern Gas Corridor: Is it a Real Game-Changer?

The volumes that Europe will receive from the SGC will not exceed 10 bcm in 2020, a figure that represents close to only two percent of Europe’s energy needs. This fact raises questions about whether the current planned capacity of the SGC can have a significant impact on Europe’s overall energy security. Fackrell responded to this by asserting that the SGC is indeed a game-changer for the region and especially for Southeast Europe. “When the Baku-Tbilisi-Ceyhan oil pipeline became operational back in 2005, it was not a game-changer for the global oil market but it was one for the region. The same goes for the SGC,” he explained. He also emphasized the economic significance of the SGC. As one of the world’s largest energy projects – in which BP is involved in every part of the value chain – the SGC is “a collaboration between seven governments, eleven gas companies, and eleven buyers,” he touted.

Brenda Shaffer, third speaker, and a visiting researcher at the Center for Eurasian, Russian and East European Studies (CERES) at Georgetown University, supplemented Fackrell’s comments by calling the SGC a “superhighway” that will promote interconnectedness throughout the region. Hengel added that enabling reverse gas flow capabilities to these interconnections – which allows countries to reroute gas in the event Russia cuts off supplies – is key in strengthening natural gas security. The Natural Gas Interconnector Greece-Bulgaria (IGB) project is an excellent example to this end. This interconnector is envisioned to connect with TAP in Greece and bring SGC natural gas to Bulgaria. If built with its proposed capacity of three to five bcm annually with reverse flow capability, it will match the volumes that Bulgaria imports from Russia.

Fackrell also reminded the audience that the SGC is ultimately planned with scalability in mind and therefore, it has the ability to double its 16 bcm capacity as new sources become available. All of the panelists pointed to Azerbaijan as the most viable source for supplying additional gas supplies to the SGC, which could come from other projects currently in development phase in the Caspian Sea.

The viability of additional supplies joining the SGC from sources other than Azerbaijan was another topic addressed by the panelists. The inaugural foundation ceremony of TANAP in March 2015 was an important first step towards Turkey’s aim to enhance its profile as an important regional transit country. Fackrell underlined that the Turkish and Azerbaijani governments requested larger pipelines to be built for TANAP – 56 inches instead of the commercially planned 48 – which could be interpreted as these governments’ forward-looking visions for bringing additional sources to TANAP.

Iran, in particular, was brought up as a potential natural gas supplier to the EU in light of its reentry into the global energy sector in the aftermath of the historic July 2015 nuclear deal. However, Shaffer provided a less encouraging view to this end, claiming: “Iran is a net gas importer; the country exports fewer volumes to Turkey and Armenia than it imports from Azerbaijan and Turkmenistan.” She argued that Iran’s natural gas industry will focus on the domestic market first and then use its volumes for reinjection into its oil fields. During the Atlantic Council Energy and Economic Summit in Istanbul in November 2015, Sara Vakhshouri, a senior energy fellow focusing on Iran, reiterated Shaffer’s position. She claimed that in the post-nuclear deal era, Iran’s primary objective will be recovering its formerly-held position as the second-leading oil exporter of OPEC. Given these circumstances, it is difficult to expect new volumes of natural gas exports from Iran in the short-term, and even in the long-term, to Europe. Shaffer also pointed out that Iran would most likely look to Asia rather than Europe for its natural gas exports, as it is a better paying market. The speakers concurred that besides Iran, Turkmenistan, Iraq, and the Eastern Mediterranean region are also facing serious political and technical problems that need to be resolved before their supplies could reach Europe.

In addition to being an important transit country, Turkey also aspires to be an energy hub for the region. To that end, Hengel explained that the Turkish sector needs “buyers, liquidity, more competition, transparency, and storage.” With BOTAŞ controlling 80 percent of the natural gas market in the country, liberalization of the gas sector is a necessity for Turkey to become a true trading hub, he argued. Fackrell was of the opinion that Ankara does not actually wish to become a hub, but wants to bring in as many resources as possible to Turkey to ensure supply security and price control. Shaffer, on the other hand, questioned the benefits of becoming a hub and claimed that it is not as important of an economic goal.

Turkey’s ever-growing natural gas demand also hampers its capacity to trade natural gas. Turkey’s consumption is expected to increase to 70 bcm by 2020 according to the Ministry of Energy and Natural Resources.[4] Therefore, any new resources coming to Turkey – such as the first line of the proposed TurkStream that will carry 16 bcm annually – will most likely be used to satisfy domestic demand. Moreover, Turkey’s downing of the Russian military jet on November 24th has put the prospects of the TurkStream into serious question. Current tensions between Ankara and Moscow over the incident could very well lead to the further deterioration of bilateral relations. This, in turn, may even affect the volumes that Turkey is already receiving from Russia.

Eastern Mediterranean: The New Frontier for Natural Gas Exportation?

Recent natural gas discoveries in the Eastern Mediterranean and implications thereof for regional geopolitics played a central role in the discussion. Shaffer pointed out the tendency to approach new discoveries in the region – such as the Zohr natural gas field off the Egyptian coast – through a “zero-sum” lens. However, she claimed that it is not the case: “One discovery does not replace another’s chance of reaching the market and in fact the more resources there will be in the basin, the greater chances there are of major exports.” According to Shafer, Cyprus and Israel’s export prospects are not affected by the Zohr discovery: Cyprus’s current volumes are too small to justify an international export project and Israel’s current volumes available for export are more likely to be exported to close neighbors.

Despite the discovery opportunities in the region, currently no single Eastern Mediterranean state can match the proven reserves of other potential suppliers to the SGC, such as Iran (34 trillion cubic meters – tcm), Turkmenistan (17 tcm), or Iraq (4 tcm).[5] For example, Cyprus’s only discovered natural gas field, Aphrodite, holds 170 bcm and Israel’s Leviathan field holds 510 bcm.[6] Thus, Shaffer argued that if major export infrastructure is to be developed, it should be intra-regional.

Shaffer questioned the benefits of selling the region’s sources instead of using those volumes for domestic consumption. As the region is mostly dependent on oil to produce electricity, natural gas could be a cheaper alternative. Stable electricity is essential for political stability and improving economic growth in the region. Furthermore, natural gas can be used to enable desalination projects, which will help eradicate the region’s water shortages – an issue long viewed as a potential flashpoint that can disrupt regional peace.

Ultimately, prevailing regional conflicts present a major impediment to the exportation of Eastern Mediterranean resources. Therefore, the peace-building power of trading natural gas was raised during the discussion. Following the discovery of the Leviathan and Aphrodite natural gas fields in the Eastern Mediterranean in 2010 and 2011 respectively, many voiced the opinion that they had the potential to foster collaboration and pave the way for breakthroughs in regional disputes between Cyprus-Turkey and Israel-Turkey.[7] However, Shaffer claimed this potential is overestimated. “In terms of ensuring peace there is no precedent for this,” she explained. The escalation between Turkey and Cyprus on natural gas prospects in the region clearly shows that the discovery of new resources complicate peace efforts, in addition to bringing about commercial disputes.

Renewables: How Do They Come into Play?

The topic of renewables and their role in today’s energy landscape was an issue that was brought to the agenda by the audience. This took on particular relevance ahead of the global United Nations Climate Change Summit in Paris that took place in early December 2015.

The panelists were of the opinion that the renewable sector is actually facilitating natural gas development. As the cleanest fossil fuel, natural gas works well combined with renewable sources. Shaffer explained that wind and solar energy in their current form need natural gas due to their fluctuations in production. When production from renewables slows down, natural gas can come in to bridge the gap.

International climate change concerns are more related to the usage of coal rather than natural gas. Hengel explained that the reason US emissions dropped in recent years is because of the shift from coal to natural gas. Energy companies are not the enemies of climate policies per se, but what they want is more predictability, Shaffer explained. This is the main logic behind preferring carbon tax measures instead of emission cap-and-trade schemes. Carbon taxes set a certain price for all emissions, which makes it easier for companies to plan ahead vis-à-vis their production costs. However, if the tax is not high enough it may not incentivize companies to invest in carbon emission reduction. On the other hand, cap-and-trade schemes put certain limitations on emissions. Any company that exceeds that limit needs to buy unused quota from another company. This scheme enforces carbon emission reduction more strictly, however, it is also the less preferred option among energy companies.[8]

In light of global efforts to divest from coal, Ankara’s decision to use its indigenous coal resources to increase its electricity production needs to be reevaluated. According to estimates, if the current planned coal-fired power plants are built, Turkey’s carbon emissions will increase by 150 percent in 2023.[9] This will be a huge burden both for Turkey’s international reputation and its efforts to become a more sustainable economy.

While renewable energy sources will become increasingly attractive, Hengel brought up an important caveat about the current capacities of renewable energy production. He explained that Germany – the front-runner of renewables – only produces four percent of its total energy from renewable sources. In electricity production this figure rises to 17 percent. He added that renewable energy technologies are both undeveloped and costly to operate. “Because of the subsidies for the renewable sector Germany along with Denmark are consuming the highest cost electricity in Europe,” he said.

Conclusions

Several key takeaways can be derived from this year’s discussion regarding the current natural gas landscape. First, regardless of EU diversification goals, Russia-EU energy cooperation will continue to be a reality. However, there is still a clear and present need to reduce energy vulnerabilities for the EU and its neighborhood in order to offset Russian dominance of the sector. To that end, US LNG exports are a true game-changer with the ability to reinforce the EU’s energy security. In that same vein, the SGC represents a tangible and genuine contribution to supply diversification architecture.

As emphasized by the panelists and participants, securing more natural gas sources will be increasingly relevant in the upcoming years. Where Turkey is concerned, the SGC has opened up new opportunities for satisfying its demand. However as the panelists pointed out, the possibility of new resources – besides to-be-developed sources from Azerbaijan – joining the SGC is unlikely in the medium-term. Moreover, it should be underlined that any opportunity must be commercially viable; if that is the case, politics are less likely to be an impediment.

Natural gas, as the cleanest of the fossil fuels, will be central to an environmentally friendly future, in combination with renewable energy sources. Given this reality, the dynamics of natural gas geopolitics will continue to be relevant in the long-term.

[1] Bud Fackrell, “The Southern Gas Corridor to Europe – Progress,” BP Turkey, http://turkishpolicy.com/files/contentfile/file-fackrell-presentation-7147.pptx

[2] “Interview with Amos Hochstein: Energy Security, Russia, & the LNG Boom,” Turkish Policy Quarterly, Vol. 14, No. 2 (Summer 2015), p. 26, http://turkishpolicy.com/article/754/interview-with-amos-hochstein-energy-security-russia-the-lng-boom-summer-2015

[3] Milda Seputyte, “Lithuania Grabs LNG in Effort to Curb Russian Dominance,” Bloomberg Business, 27 October 2014, http://www.bloomberg.com/news/articles/2014-10-27/lithuania-grabs-lng-in-effort-to-curb-russian-dominance

[4] Gülmira Rzayeva, “Natural Gas in the Turkish Domestic Energy Market,” The Oxford Instıtute for Energy Studies, February 2014, p. 9, http://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/02/NG-82.pdf

[5] “BP Statistical Review of World Energy,” BP, June 2015, p. 20, http://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-natural-gas-section.pdf

[6] “The prospect of Eastern Mediterranean gas production: An alternative energy supplier for the EU?,” European Parliament, April 2014, p. 6, http://www.europarl.europa.eu/RegData/etudes/briefing_note/join/2014/522339/EXPO-AFET_SP(2014)522339_EN.pdf

[7] Matthew J. Bryza, “Eastern Mediterranean Natural Gas: Potential for Historic Breakthroughs Among Israel, Turkey, and Cyprus,” Turkish Policy Quarterly, Vol. 12, No.3 (Fall 2013), http://turkishpolicy.com/article/645/eastern-mediterranean-natural-gas-potential-for-historic-breakthroughs-among-israel-turkey-and-cyprus-fall-2013

[8] “Carbon tax or cap-and-trade?,” David Suziki Foundation, http://www.davidsuzuki.org/issues/climate-change/science/climate-solutions/carbon-tax-or-cap-and-trade/

[9] Jörn Richert, “Coal’s Not Cool: Energy & Turkey’s Reputation,” Turkish Policy Quarterly, Vol. 14, No. 2 (Summer 2015), p. 94, http://turkishpolicy.com/article/761/coals-not-cool-energy-turkeys-reputation-summer-2015